Although new HOS flats and those eligible for purchase by buyers with White Forms are both subsidized housing provided by the Housing Authority (HA), the first programme involves first-hand properties, while the latter involves used HOS flats before premiums for them are paid to the government.

Aside from the differences in support facilities, the biggest distinction between HOS and flats covered by White Forms is the age of residential buildings. For instance, the age of second-hand HOS flats is more than 20 years.

If the age of a flat is close to the end of the guarantee period, then an eligible buyer may not be able to take out mortgage loans up to 90 percent of the value of the flat that he or she wishes to buy.

HOS flats carry a guarantee period

All HOS flats are covered by a 30-year government guarantee, starting from the date of the first assignment. With this guarantee, there might be instances of homebuyer applicants stopping or unable to complete repayments of mortgage loans, but the government will step in to cover or pay the unpaid portion of a mortgage loan.

Because of this support mechanism, White Form Applicants for new HOS flats can borrow from a bank up to 90 percent of a property’s value and enjoy the waiver of premium payments.

The mortgage term is up to 25 years without needing to undergo and pass a bank’s stress test.

Age of buildings and flats for eligible homebuyers who hold White Forms

Compared with the limited supply of new HOS flats, there are ample of choices in the HOS secondary market. Because of this, many eligible buyers with White Forms prefer buying units in the secondary market. However, those who are interested to buy second-hand HOS flats need to pay attention to the age of the residential projects as the age of buildings are taken into account by banks when assessing mortgage loan applications.

Some banks directly subtract the age of an HOS flat from the 30-year government guarantee before determining the maximum repayment period for the 90 percent home mortgage loan sought by a homebuyer.

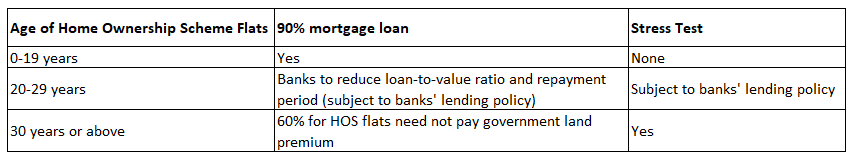

Generally, banks will provide 90 percent mortgages for second-hand HOS flats aged 19 years or less, and a repayment period of up to 25 years.

HOS flats above 20 years will receive lower loan-to-value ratio for mortgages

As regards second-hand HOS flats aged between 20 and 29 years old, the remaining government guarantee is only 10 years or less, putting at risk bank loans.

The outstanding balance in a mortgage loan cannot exceed 60 percent of the price of a property once the govenrment’s guarantee period is over.

In this situation, the bank will deduct the mortgage repayment period or the mortgage ratio. The buyer cannot take out a loan equivalent to 90 percent of the value of a flat, or if the repayment period is less than 25 years. The bank uses a table that shows the different mortgage ratios for second-hand HOS flats of different ages.

For instance, if the government guarantee has exceeded 25 years and only 5 years are left in the government guarantee, and if a borrower wants to apply for a 90 per cent mortgage, the loan for the outstanding must be reduced to 60 per cent payable within 5 years. The monthly mortgage installment in this case will be higher.

Since the remaining government guarantee period is too short, the bank may require the applicant to provide proof of income. The mortgage loan application will only be approved after the borrower passes the standard stress test, but this will be subject to the policy of each bank.

After the guarantee period, the mortgage ratio drops from 90 per cent to 60 per cent

In the case of second-hand HOS flats in which land premiums have not yet been paid to the government after the 30-year government guarantee period, the mortgage rate drops from a maximum of 90 percent to 60 percent, and an income proof and a stress test are required. So when buying second-hand HOS flats aged over 30 years, buyers need to prepare more money for down payment.

Mortgages for different HOS projects in the secondary market are determined by the bank.

Please refer to Table 1