Midland Confidence Index

This week's Midland Confidence Index

This week's Midland Confidence Index

84.5

Update Date: 02/03/2026

WoW+1.7%

MoM+5.1%

Show Property Price Index

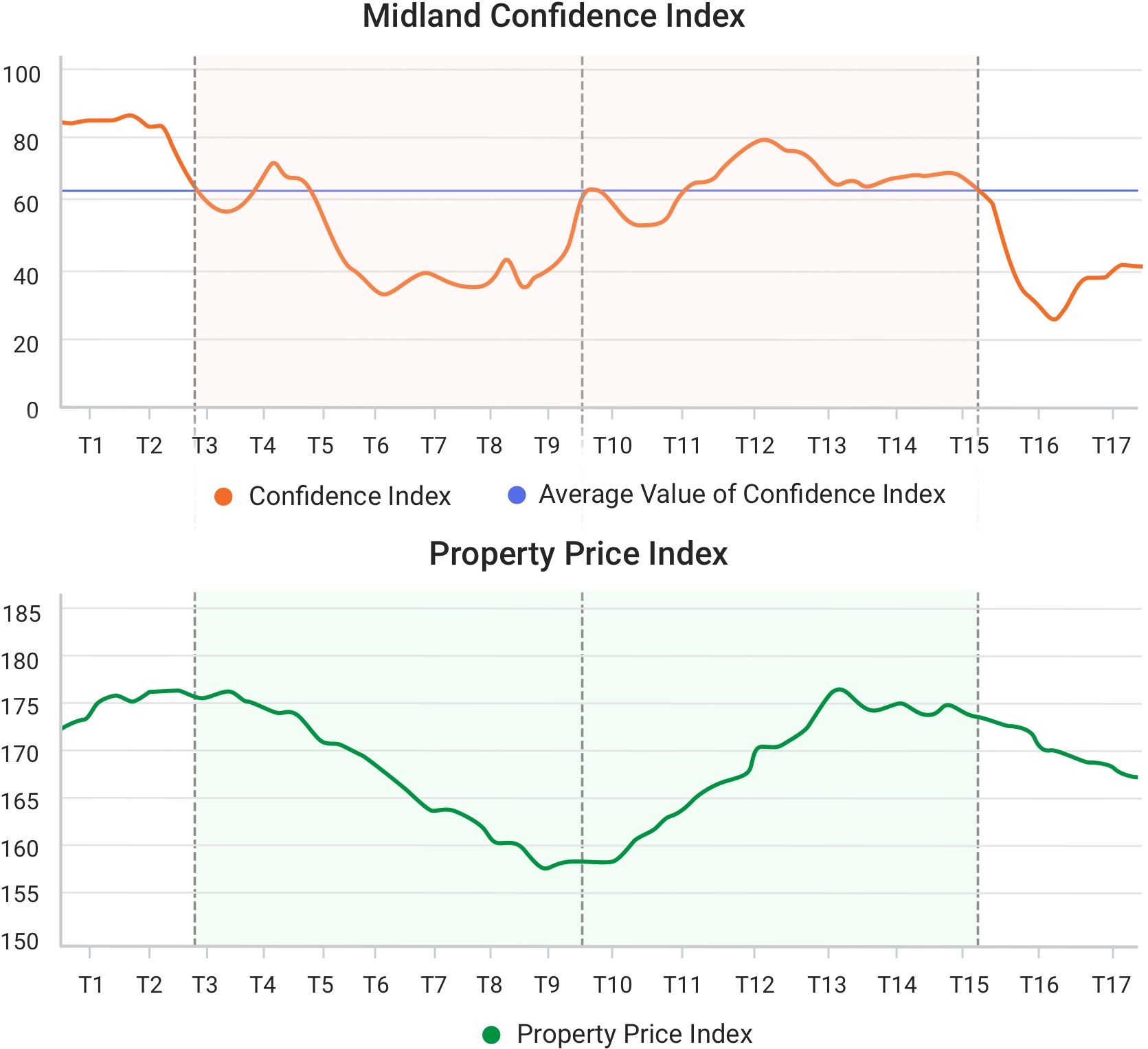

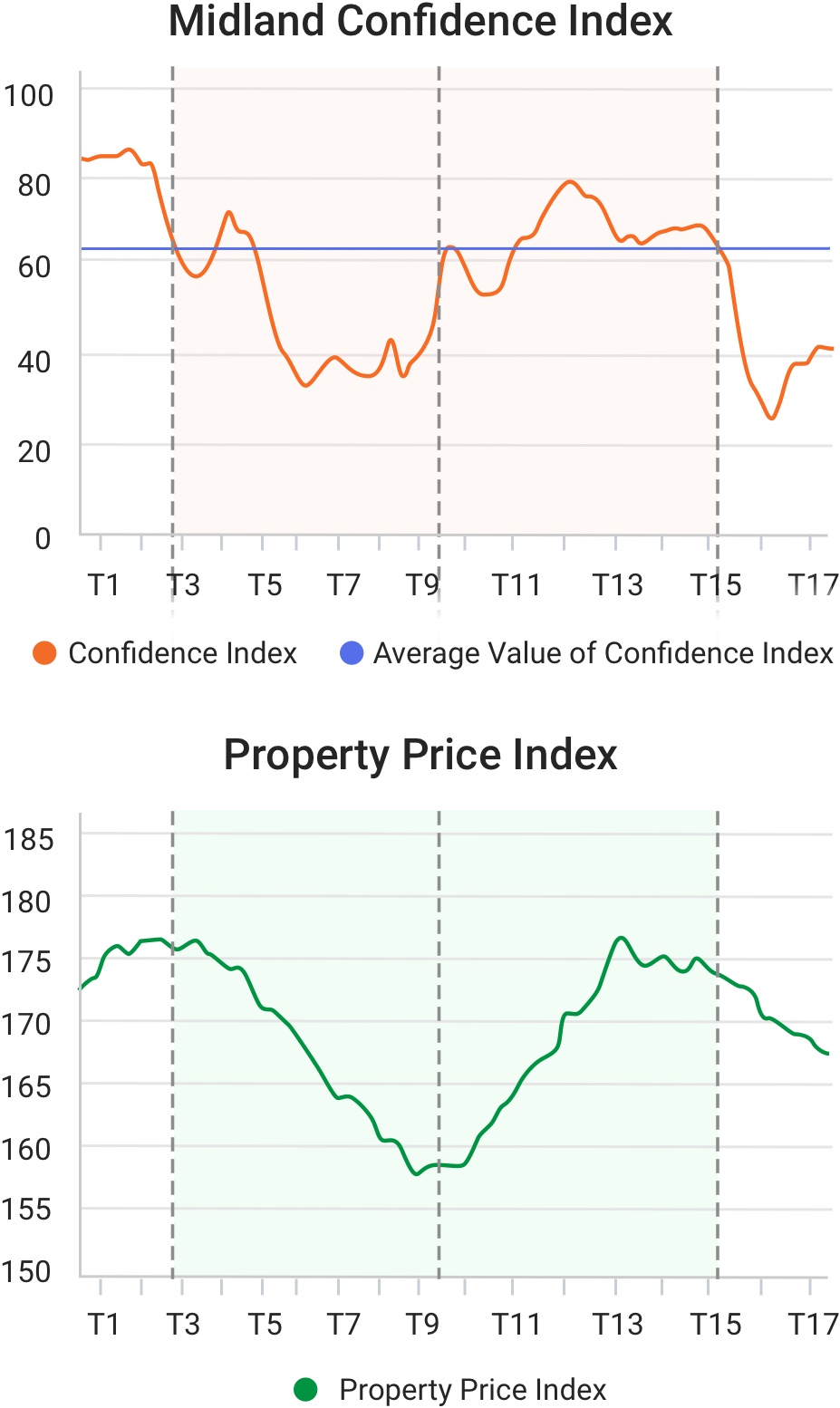

Midland Confidence Index is calculated based on price changes of properties for sale on the Midland internet

Midland Property Price Index (All) is compiled from the weighted average of transaction records of the 143 most popular secondary housing estates in Hong Kong. Besides, 2022 figures are based on 138 housing estates, 2008-2021 figures are based on 100 housing estates, figures before 2008 are based on 50 housing estates.

All of the above information is compiled from the registration record of the Land Registry and the database of Midland Realty, and is for reference only. Although reasonable and cautious measures are applied to prepare the above information, if there is any inconvenience or loss caused by any mistakes, it is not the responsibility of Midland CyberNet Limited.

A brief introduction of the Midland Confidence Index

- Midland Confidence Index(“The Index”) is calculated based on price changes of properties for sale on the Midland internet

- The index reflects degree of confidence of owners who have put their properties for sale, and it is estimated that the influence of market news on owners’ confidence will be reflected on the index one week later

- Midland Confidence Index can be used to infer the trend of Midland Property Index four weeks later

- When the index gets higher, it reflects fewer price cut among properties for sale and market optimism, property price is likely to go up

- When the index gets lower, it reflects more price cut among properties for sale and market pessimism, property price is likely to go down

- Thus, the Index= 100 represents that almost all owners are optimistic, while the Index=0 represents that almost all owners are pessimistic on the property market

- Average Value of Confidence Index is the average of the index since 2018, and it tells whether the owners are optimistic or pessimistic on the property market

- The property price is likely to stay flat if the Index is moving towards the Average Value of Confidence Index

- The property price is likely to rebound or rise more quickly if the index is moving beyond the average of the Average Value of Confidence Index

- The property price is likely to peak or drop more quickly if the index is falling below the Average Value of Confidence Index

- The Index is highly correlated with the Midland Property Price Index, and can be used as a prediction on the trend of Midland Property Price Index. Nevertheless, how owners price their properties for sale is just one of the many factors that affect property price. The movement of Midland Property Index is also affected by supply, interest rate and the macro economic environment etc. Therefore, the index is not the only nor decisive factor for the property market.